Insurance

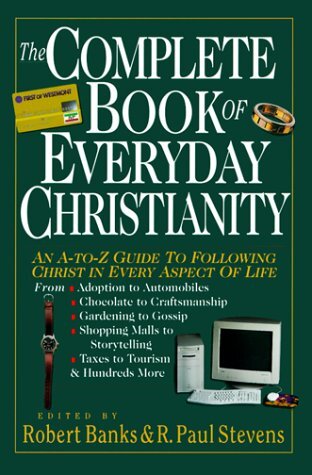

Book / Produced by partner of TOW

Insurance is a means by which individuals, families, businesses and other organizations reduce or eliminate financial uncertainties in areas of life where there are predictable possibilities of financial loss. People exchange a small but predictable amount of money, their premium, for a larger, uncertain loss. Because the insurer can predict average losses over a large population, the risk is evened out and shared. The fortunate many who escape major loss help the unfortunate few who experience it. Kinds of insurance normally purchased by individuals include life, fire, theft or damage to personal property, legal liability, disability, unemployment, health and travel insurance.

The Insuring of Almost Everything and Everyone

Individuals, of course, buy some of these types of insurance for personal protection. Groups like businesses or corporations buy insurance for their employees; business partners may buy it to provide the means of buying out a partner’s share in business upon his or her death. In Canada and other countries with a social welfare philosophy, the government or state agencies buy insurance by means of taxes. Insurance provided by the state in this way is compulsory rather than voluntary.

Insurance, however, protects not only individuals (and by extension their families) but also corporations, nonprofit agencies and governments. They may insure to cover the safe transfer of goods, the reliability of monies deposited in banks, the nonpayment of loans and the loss or destruction of major assets. Of course, though it may not be obvious to the person or organizations purchasing insurance, many significant risks cannot be reduced through insurance: war and insurrection, nuclear holocaust, ecological disaster (acts of humankind widely and over time) and natural disasters of colossal proportion (commonly called “acts of God”).

In the Western world many individuals use a significant percentage of their income to pay for various forms of insurance, in excess of 10 percent in many cases if compulsory insurance provided by taxation is also considered. Some people complain of being “insurance poor”—spending so much to cover potential losses in the future that they have not enough to live properly today. Others are underinsured and may face a future without either personal assets or social network to cover major losses or reverses. In most developing countries individual insurance is the privilege of the rich and powerful; the poor and middle class rely on the age-old securities of family and church. Significantly, before there was a major insurance industry, the church pioneered in establishing burial societies during times of plague and mutual aid societies (especially for widows, orphans and the destitute), providing hospitality and asylum to fugitives, travelers and shipwrecked seamen; and setting up the first hospitals for the sick—a stunning and little-told story (Oliver, p. 116).

Is insurance merely a modern invention to satisfy an artificially induced need in the consumer society? Is there a biblical foundation for buying and selling insurance? When does protecting against risk become a refusal to trust God?

The History of Insurance

While widespread provision of insurance is a relatively modern affair, the idea of insurance has a long history, dating to ancient Babylon many centuries before Christ. Marine insurance was the first. It covered potential losses by traders and merchants who had to borrow funds (using their ships as collateral) to finance their trade. According to contract, if the merchant was robbed of his goods, suppliers agreed to cancel the loan in exchange for a premium paid. This was formalized in the Code of Hammurabi. The Greeks, Hindus and Romans borrowed some of these codified arrangements and adapted them.

Life and health insurance had beginnings in ancient Greece (600 b.c.) and became part of the benefits of belonging to guilds and trade associations, the precursors of modern unions. The first insurance contract was signed in Genoa in 1347, and the first life insurance with “insurable interest” (a.d. 1430) concerned the lives of pregnant wives and slaves. England developed “Friendly Societies” to insure industrial workers, and the Great Fire of London (1666) propelled the fire insurance industry forward. Lacking solid actuarial research and administrative know-how, many fledgling attempts to provide insurance folded, including some early attempts to establish insurance companies in the North American colonies. The first permanent life insurance company was formed in the U.S. in 1759; then followed health insurance (1847), automobile (1898) and group hospitalization (1936). Some of these companies were and are mutually owned by the insured; others operate as corporations with shareholders. Major factors in the evolution of multifaceted and near-universal insurance in the Western world are industrialization (with its hazards for injury and loss), urbanization (with its attendant risk of theft), mobility (with the loss of a stable family support group and land that can be worked) and privatization (with the reduction of society to the autonomous individual [see Individual]).

Thinking About Risk

At first glance the Bible seems to advise us not to think about future risks. The birds and lilies do not worry. “Yet your heavenly Father feeds them” (Matthew 6:26). It is the unbelieving Gentiles who run after all these things (food and clothing). But Jesus is not condemning us for planning for the future so much as warning us not to be anxious about it: “Do not worry about tomorrow, for tomorrow will worry about itself” (Matthew 6:34). We cannot add a day to our life by worrying; probably we will do the reverse. Indeed the way we respond to risk is a significant thermometer of our faith and spirituality.

Insurance does not deal with all risks, and perhaps not even the most important risks, such as losing friendships, personal worth, love, hope or faith. No one through buying insurance can guarantee long life, good health, satisfying work, personal contentment, a happy marriage, good neighbors, intimate friendships and children that bring joy to the heart. On a grand scale we cannot insure against the breakdown of a whole society or the ecosystem (though there is much we can do to prevent these). There is no insurance that can be purchased against marriage failure, loss of meaning, personal suffering or, most crucial of all, our eternal salvation.

We cope with risk in several ways: by ignoring it, assuming (or retaining) it, eliminating the possibility of loss, transferring the loss to someone else, or anticipating the loss and planning toward it.

On the first two options, it is folly to ignore risk, a game of let’s pretend that is bound to catch up disastrously with reality someday. We must assume or retain the most important risks and the most crucial potential losses. For the Christian this means trusting in God’s providential care, believing that even temporary reverses will be transformed into general good, as exemplified by the victory of the cross of Jesus. By retaining or assuming these noninsurable risks, we are called not only to trust God but to exercise faithful stewardship of our life, marriage, home, driving, possessions and ultimately the environment. God is the ultimate owner of everything; what we render is stewardship or regency. So the proper management of our lives is intended to reduce risk. Keeping an automobile in good repair, for example, is assuming the risk and managing it by good stewardship.

In most cases the third option, eliminating the possibility of loss, can be done only by refusing to accept the adventure of life. Driving a car, traveling, investing our talents in a community, getting married, having children and even joining a church are risky enterprises. Tragically, some people are like the one-talent man in Jesus’ parable (Matthew 25:24-25), protecting themselves against any possible loss and so losing what they thought they had. People who refuse to invest themselves in order to eliminate all possible losses end up losing something more precious than what they protected—the joy of life.

Transferring risk to someone else, the fourth option, is not something we can normally do with risks that we must personally undertake. But this is an acceptable way of coping with some potential financial losses that could ruin one’s business in a single stroke. For example, a surety bond guaranteeing the completion of a building according to written specifications transfers the risk from the person building the structure to the insurer. Such ways of managing risk are called for in a society that is composed not merely of a collection of individual farmers or tradespeople but of corporations and powerful structures.

The most common way to manage risk is to share it through buying insurance. Most insurance is simply a form of neighbor love expressed impersonally without knowing who our neighbors are. The insurance company becomes our symbolic neighbor. Through knowledge of past experience, careful prediction of future possibilities and accumulation of funds over a wide population base, insurance companies are able to cover the enormous losses of a few and the minor losses of the many, and have enough left over to cover their operating costs and make a legitimate profit for the shareholders.

Prayerful Insurance

Here are a few guidelines for Christians to consider when thinking about insurance.

Plan wisely for your family’s future. In many cases it is unloving not to buy insurance, since it may force your family to embrace involuntary poverty to care for you in a time of extreme need. Wisely insuring is a form of neighbor love and part of our stewardship. But one must be careful that the companies trusted with funds are reliable since there are many cases of bankruptcy. Companies like Standard & Spoors and Moody’s, and a new index called TRAC rate insurance companies for their strength, liquidity and solvency. Advertised reliability is not a sufficient guide.

Keep insurance in perspective; don’t overvalue it. Our eyes can all too easily be diverted from the uninsurable risks that are much more deserving of our stewardship and prayerful attention: marriages, self-esteem of children, friendships and the joy of our salvation.

Never let buying insurance be an alternative to trusting God. An advertisement for an insurance company boasted, “A promise I’m forever watching out for you.” Only God can do that. As Jesus said, our heavenly Father knows what we need and cares for us. Even more, we have an exuberant, risk-taking God who wants his creatures to experience life as an adventure. Significantly, the problem of the fearful investor in the parable of the talents (Matthew 25:24) was not his analysis of a potential loss but his conception of his master (representing God) as one who could not be trusted with his mistakes and reverses.

Beware of overinsuring. It is just as foolish to become “insurance poor” as to ignore insurable risks. We are meant to enjoy life and to thrive, not live cramped little lives. Often, insurance can be reduced or not even purchased (as in the case of collision insurance on a car) if one has put aside savings that can be used in the eventuality of a sustainable loss. Very valuable possessions (like inherited items) may be too expensive to insure, and wise management, combined with the attitude of “holding things lightly,” is more prudent than covering every eventuality. Simpler living is a matter of perspective and not just net worth. A wise philosophy is to self-insure for small problems and use an insurance company’s money for large ones. When looking at disability insurance, for example, we should choose a longer waiting period (90 to 120 days) so that in the event of disability we can use our own resources for the short term, thereby reducing the cost. Some people recommend as a rule of thumb purchasing ten times one’s income in life insurance.

Help family members sustain their losses. It is lamentable that the basic unit of Western society has become the isolated individual covering all his or her potential losses rather than the family looking after one another. Insuring everything possible may inadvertently assist in the dissolution of the one organic community, besides the church, that can provide care and support during times of crisis and loss. Families can agree together what risks they will undertake mutually, including care of people when they are sick or old. Jesus roundly condemned the Pharisees for neglecting their responsibilities to their parents, a form of “honoring” them (Exodus 20:12) by dedicating their assets to the Lord’s work, a system called corban (Matthew 15:3-6). Paul says that if we do not care for our own families we are worse than unbelievers (1 Tim. 5:8).

Lend aid to others in the body of Christ who need it. The church has an important role to play as the equalizer of risk. In the earliest church in Jerusalem, people sold their surplus goods to provide for anyone in need (Acts 2:44-45; Acts 4:32-37). Later came other forms of economic sharing, such as famine relief (Acts 11:27-30), occupational sharing (Aquila and Priscilla with Paul in making tents) and mutual aid gift-giving (the great love gift from the Gentile church—1 Cor. 16:2; 2 Cor. 8-9). It is all too easy to claim it would never work in our urbanized, mobile society where most people move every four or five years. But a commitment to a house church or an intentional community not to move (see Mobility), while countercultural, may be a concrete step toward true community (see Fellowship). We have something to learn from churches in the developing world on this matter. When someone dies in Kenya, the church gathers to make gifts to the family —not just the grieving spouse—to provide a living and a future for the survivors.

Remember those in society who are uninsured (the disadvantaged and destitute), and act on their behalf. In our modern times risk and loss are systemic problems, not merely matters of personal character and integrity. The Scriptures warning against idleness assume that unemployed people are lazy, whereas today the unemployed are often victimized by systemic problems, sometimes through economies halfway around the world. So in coping with risk today, we must exercise cultural and organizational as well as personal stewardship (see Principalities and Powers). We must fight against the abuse of unemployment and health insurance schemes if they are government-funded and abused. We need to lobby for legislative change to care for disadvantaged and marginalized people in our society.

Conclusion

Like most advances in the Western world, the growth of the insurance industry is a mixed blessing. With careful management, reaffirmation of the providence of God and wise stewardship of our lives, buying some insurance is an act of neighbor love and personal responsibility, doing what we can so we won’t be a burden on others (1 Thes. 4:12; 2 Thes. 3:8). In reality, we can never eliminate that possibility fully. And where true family and church community exist, mutual caring is not a burden but part of the unlimited liability of family love. The temptation of too much insurance, or a wrong attitude, can lead to an illusory feeling that we can control our own futures and live autonomously without God. Like many facets of everyday life, this one calls us to a life of prayer, spiritual discernment and loving action.

References and Resources

J. L. Athearn, Risk and Insurance (St. Paul: West, 1981); K. Black Jr., “Insurance,” in The Encyclopedia Americana (Danbury, Conn.: Grolier, 1989)15:233-39; K. Black Jr. and S. S. Huebner, Life Insurance (Englewood Cliffs, N.J.: Prentice-Hall, 1982); E. H. Oliver, The Social Achievements of the Christian Church (Toronto: United Church of Canada, 1930); N. A. Williams, Insurance (Cincinnati: South-Western Publications, 1984).

—R. Paul Stevens